A large amount of strategic resource—rare earth,

were sold overseas at very low prices.

According to China Customs, China exported

4,343 tonnes of rare earth in March 2016 and an accumulative 11,600 tonnes in the first

quarter, with a year-on-year growth of 109.4%.

The main reason for the soaring exports is

that early last year, the Ministry of Commerce of China canceled the licensing

system for export quotas that has been implemented for as long as 17 years. That is

to say, China’s rare earth exporting would not be restricted by the gross

amount of the quotas but by right of exporting contracts. According to China Customs,

the accumulative export of China’s rare earth was 34,800 tonnes last year, with

year-on-year growth of 25.4%.

The change of the policy is aimed to

implement the final verdict made by WTO in August 2013. The verdict supported

the appeals from the US, Europe and Japan and believed that China’s restriction

on rare earth exporting violated the rules of WTO.

China owns the biggest rare earth reserves

and keeps the highest output all across the globe. Accounting for 23% of the

global total reserves, China supplied more than 90% of the rare earth all

around the world. It has long been accused in China that rare earth, as an

important and rare strategic resource, has been sold abroad

cheaply in a large amount.

“China

has not gave up regulating and controlling on the rare earth exporting; it's just

transferring the regulation and control from the exporting restriction to the

mining,” said senior metal analyst Zhang Wei. Just like what has happened in

the surplus industries of steel and coal, China’s rare earth industry has also

carried out the reform of supply front.

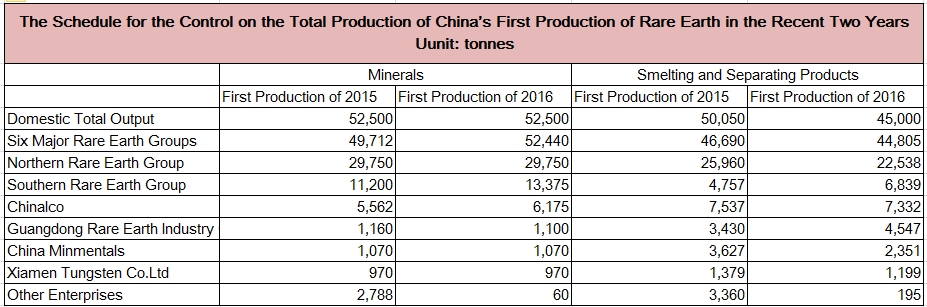

China’s Ministry of Industry and

Information and Technology (MIIT) published its plan of master controlling on

the first production of rare earth production on 5 April, among which the

planned total production of minerals is 52,500 tonnes, the same as that of last

year; while the planned output of smelting and separating products is 45,000

tonnes, a 10% or 5,050 tonnes decrease compared with that of

last year.

The reduction stirred the industry. “The

market will go mad if there’s more reduction”, according to Zhang Wei. Even

though the reduction could increase the price, it will cause unnecessary

turbulence across the market.

Source: MIIT

However, if the illegal-exploited rare

earth production is not curbed, the solely reduction on the legal rare earth

production will not decrease the domestic supply to the oversea market.

China’s light rare earth is mainly

distributed in Northern China and Liangshan Mountain of Sichuan Province, while

the ionic middle and heavy rare earth was mainly in Southern China, like

Jiangxi, Guangdong, and Fujian Province. After years of disorderly

exploitation, the ionic rare earth in Southern China, which is the priority

protective minerals of China’s government, has been greatly destroyed.

The illegal-exploited rare earth was mainly

in areas of Ganzhou, Guangxi Province and Fujian Province. According to rare

earth analyst Yang Wentao, “The quota of Ganzhou last year was 8,500 tonnes,

while its actual output was near 30,000 tonnes, among which most of productions

are illegal.”

To protect rare earth resource, China began

to implement the restrictions on rare earth exploitation since 2011. MIIT

issued the Entry Conditions of Rare Earth

Industry on July 2012. The Conditions requires all the enterprises that

worked on the mining, separating, and producing of the rare earth have to

rectify and reform their operation in accordance with the Entry Conditions.

The legal rare earth oxides output was

about 105,000 tonnes, while the illegal-exploited rare earth production was

expected to be more than 40,000 tonnes.

The industry has placed high expectations

on the establishment of Northern Rare Earth, Southern Rare Earth, Chinalco,

Guangdong Rare Earth, Minmentals, and Xiamen Tungsten, it believed that those

groups would integrate the rare earth mines and enterprises in the respective

areas and thus to renovate the disordered market.

The exploitation quotas released this time

were gathered to the six major groups. The concentration ratio of the minerals

quotas increased by 5.2 percentage point to 99.9% on the year-on-year growth,

and the ratio of smelting and separating products was also increased to 99.6%.

The Northern Rare Earth Group acquired half of the quotas in both the minerals

and smelting and separating products.

The integration of the six major rare earth

groups does not mean the cure on the problem of illegal-exploited rare earth,

as the illegal earth production is secluded and lucrative. According to Zhang

Wei, although the purity of the illegal-exploited rare earth is lower than the

legal product, the price is 20% to 30% lower as well, therefore there’s huge

market for the illegal-exploited rare earth.

“The

government would not let the current situation alone, but if the problems of

the illegal-exploited rare earth remain unsolved, the idea of regulating the

resource exporting through controlling the exploiting would be hard to achieve,”

said an unnamed person of the industry.

*This article is an edited and translated version by CCM. The original article comes from Jiemian.com.

You could visit CCM PESPESTIVE for more information about China.

About CCM:

CCM is the leading

market intelligence provider for China’s agriculture, chemicals, food

& ingredients and life science markets. Founded in 2001, CCM offers a

range of data and content solutions, from price and trade data to

industry newsletters and customized market research reports. Our clients

include Monsanto, DuPont, Shell, Bayer, and Syngenta.

For more information about CCM, please visit www.cnchemicals.com or get in touch with us directly by emailing econtact@cnchemicals.com or calling +86-20-37616606.